Agility and diversity: How to succeed in today’s sports broadcast landscape

By Madelene Gustavsson, head of product, OTT, contribution and distribution, and content discovery, Red Bee Media

Competitive sport dates back to ancient times, but its popularity has been reinvigorated in the past decade. Even during the past two years the reach and value of sports have transformed, thanks to the pandemic. According to Research and Markets, the collective global sports industry is set to hit half a trillion dollars in value in 2022. This is a drastic increase from Reuters’ 2012 global sports market value predictions of $141 billion.

Not only has the economics of this segment shifted, but so has the way fans and viewers interact with sports content and broadcasters’ role in that journey. Even the term broadcaster is somewhat out of place in a world where sports content is increasingly delivered via diverse sources.

A recent survey from Sky found that nearly half (46%) of fans regularly watch sports on mobile devices. These findings highlight the need for sports content delivery to be more flexible and demonstrate the market’s diversity as media companies expand across rights holding, content acquisition, packaging and delivery – for cable, satellite, digital TV and mobile.

State of flux

Today, most major football clubs have their own direct-to-consumer (DTC) offering – from Arsenal to Swansea FC – that offers video content, including pre-season and exclusive content. This is also true across other sports, such as surfing and motocross. The allure of DTC for sports federations is creating an explosion of both live and highlighted content fuelled by diehard fans that can be accessed almost anywhere, on any device.

The sports market is in a state of flux due to the explosion in demand for sports content, greater availability of club-owned offerings and high profile bids by streaming giants for content rights. The value of sports rights deals has fluctuated, as has the duration of said deals. While some leagues have seen net declines in broadcast rights values, others have seen increasingly complex agreements comprising various delivery formats, regional broadcast windows, national and international rights agreements, and other considerations. Half a dozen large broadcasters owned most major global sports rights deals two decades ago. Today, there are over 30 significant sports content owners, and this diversity is growing rapidly as the largest SVOD services enter the market and compete with traditional broadcasters.

Agility, now a necessity

For broadcasters, becoming more agile is an even greater priority than before. Agility is a buzzword often overused in the industry, but for a good reason, because the reality is that the operating model, partnerships and a whole host of technical considerations must be able to adapt quickly. This was the reality for BT Sport after it acquired the English Premier League broadcast rights in June 2012. It was imperative that the channel provider was up and running with a complete delivery workflow to reach millions of viewers across multiple devices within just 12 months. Or take Extreme E, the electric off-road racing series that launched as a start-up in 2018 and within three years expanded its distribution reach to encompass 195 countries with a cumulative audience of 316 million in 2021.

Both companies leveraged a media services partnership approach to help build and operate complete media workflows from the ground up. This brought access to mature and forward-leaning infrastructure and proven expertise that delivered outcomes based on deep technical capabilities, as well as reduced the risk to deliver a next generation of breakout services. In this way, flexibility is a catalyst for innovation. In the case of BT Sport, this flexibility capability meant being able to rapidly expand its workflows to encompass the UEFA Champions League and its launch of Europe’s first UHD sports channel in 2015.

The power of media service partnerships

The ability to become more agile is not isolated to big players. In fact, emerging sports leagues’ agility is arguably the most notable. Ekstraklasa SA, the Polish top-tier football league, is an excellent example of this trend of melding commercial models and flexible delivery to meet new expectations among an increasingly global fan base.

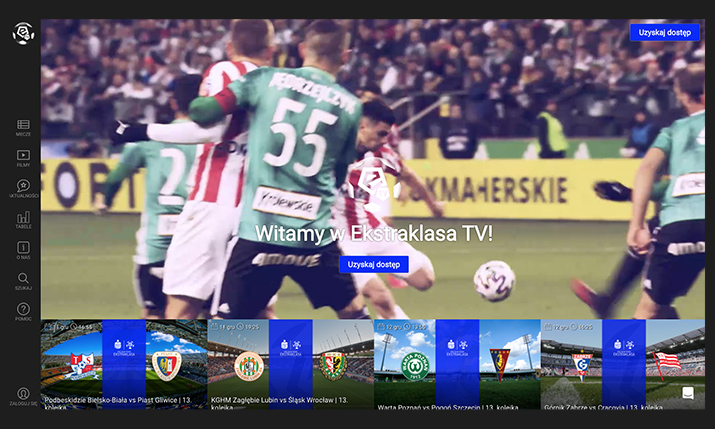

Ekstraklasa.TV is a streaming service offering live and on-demand content, including over 300 matches per season. Extra video content is available over the web, through mobile apps and on multiple smart TV platforms. It has several hundred thousand registered users worldwide. After purchasing a subscription or single-match pay-per-view access, fans abroad can watch Ekstraklasa games live along with highlight packages. Today, over 20 million people have warmly welcomed the service.

Ekstraklasa SA was not a broadcaster. But through a media services partnership, it went from concept to hundreds of thousands of viewers in a process measured in months, not years. It was a journey that mirrors a new breed of sports broadcasters adopting this partnership model to gain outcomes rather than uncertain capital investment – a significant benefit in a sports media market still going through a period of massive change.

The past few years in the sports video market have been instrumental in bringing about significant and exciting change. The future undoubtedly holds the promise of even more change as innovators test the waters with new ideas. Areas such as gamification, interactivity, betting and 5G connectivity are in play – and previously niche sports are becoming more widely accessible. Red Bee is ready – are you? Game on!